I’ve usually reserved my post on James Capital to my quarterly updates, but as of recent, I’ve felt compelled to share my conviction about a sector of the economy that I feel will continue to grow, creating amazing margins, and become the financial bedrock for many young investors. My conviction is that semiconductor companies will be what oil companies were to the 20th century, the middle man that powers the global economy.

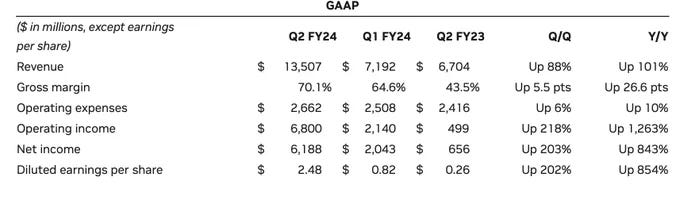

Recently, Nvida reported their quarterly earnings. They came in well above analyst expectations. See below.

The company reported gross margins of 70%! With a net income of close to 6.1 Billion. These are hall of fame numbers.

Not only that, the company authorized share buybacks of up to 25 Billion dollars. This is on the larger end for all companies listed on the NYSE. See below.

I use Nvida as a proxy to a whole sector that is about to explode. I have a few reasons why I think this is the case:

Humans will quickly adjust using AI in their daily lives. It’s shown that humans adapt quite quickly to new circumstances. There is a hedonic complex at play. Expectations + time = obligations. It’s hard to imagine a world in which a task which is completed at half the time using AI reverts back to 2x the time under normal human time task completion.

Semiconductors companies have some of the deepest moats. Infrastructure wise (think manufacturing), Patents, and human capital. These things take years, if not decades to get up and running. For example, look at Intel’s 20 billion dollar investment into building out it’s Fab plant in Arizona. These are not small, one-time, investments. Think maintenance and continuous upgrades.

Semiconductors are inherently high-margin products because of their necessity in most of the products (think iPhones, computers, planes, cars) we use along with the fact that there are only a handful of companies world-wide that makes them (TSMC, Intel, Texas Instruments, Nvidia). Because these chips go into products that are also high-margin and quickly depreciating (again think cars, iPhones, planes), there’s always a lot of demand.

Artificial intelligence. Recently, I listened to a podcast with Jordan Harbinger and Marc Andreesen where they spoke about AI and its case for the future. A little background here, Marc Andreesen can be considered one of the co-founders of the web browser. He now runs a VC fund called A16z. A literal icon in silicon valley. Jordan and Marc spoke about the compounding effect of AI, from it’s ability to answer questions, generate content, make art, and automate tasks. Because think like these are process heavy for the average computers, semiconductors need to become more efficient and handle such large task. All in all, once we’ve opened that Pandora’s box of AI, there’s no way to get the genie back into the bottle.

For these four reasons, it’s safe to make any index fund or ETF that is semiconductor heavy a large part of your portfolio, especially if you’re young. I truly believe that we’re at the start of the fourth industrial revolution. The world will look extremely different 5, 10, 15 years from now. A lot of things that we could not even imagine will become a reality. So, strap in and enjoy the ride.

la vie en rose,

Daviel